All Categories

Featured

Consider Utilizing the DIME formula: DIME stands for Financial debt, Income, Home Mortgage, and Education and learning. Overall your financial debts, mortgage, and college costs, plus your wage for the number of years your family requires protection (e.g., up until the children are out of the house), and that's your coverage requirement. Some financial professionals compute the quantity you need utilizing the Human Life Worth viewpoint, which is your lifetime earnings prospective what you're making now, and what you expect to earn in the future.

One way to do that is to try to find companies with strong Monetary toughness scores. what effect can a long-term care benefit rider have on a life insurance policy. 8A business that finances its very own plans: Some business can sell policies from one more insurance provider, and this can include an added layer if you wish to transform your policy or down the roadway when your family members needs a payout

The Combination Of Whole Life And Blank Term Insurance Is Referred To As Family Income Policy

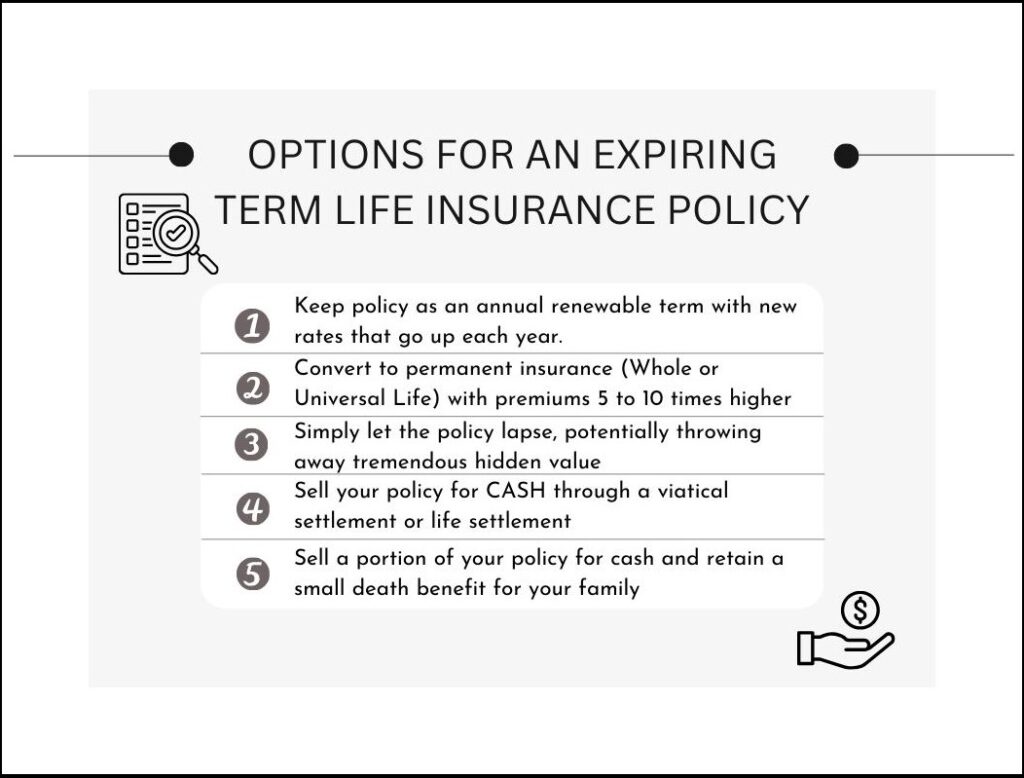

Some firms provide this on a year-to-year basis and while you can anticipate your rates to climb substantially, it might be worth it for your survivors. One more method to contrast insurer is by looking at online customer reviews. While these aren't likely to inform you much concerning a business's monetary stability, it can tell you how easy they are to function with, and whether claims servicing is a trouble.

When you're more youthful, term life insurance policy can be a straightforward way to safeguard your enjoyed ones. As life changes your economic concerns can also, so you might desire to have whole life insurance for its life time coverage and additional benefits that you can use while you're living.

Approval is guaranteed despite your wellness. The costs won't increase once they're set, yet they will increase with age, so it's a great idea to lock them in early. Discover out more concerning just how a term conversion works.

1Term life insurance provides momentary defense for a vital duration of time and is normally much less pricey than irreversible life insurance policy. guaranteed renewable term life insurance. 2Term conversion standards and limitations, such as timing, might apply; as an example, there might be a ten-year conversion privilege for some items and a five-year conversion advantage for others

3Rider Insured's Paid-Up Insurance policy Acquisition Option in New York. There is a cost to exercise this rider. Not all participating plan proprietors are eligible for rewards.

Latest Posts

10 Year Renewable Term Life Insurance

Aig Burial Insurance

Final Burial