All Categories

Featured

Table of Contents

There is no payout if the plan ends prior to your death or you live beyond the plan term. You might have the ability to restore a term policy at expiration, yet the premiums will be recalculated based upon your age at the time of renewal. Term life insurance coverage is generally the the very least costly life insurance policy offered due to the fact that it provides a fatality benefit for a limited time and does not have a cash worth component like permanent insurance policy.

At age 50, the premium would certainly increase to $67 a month. Term Life Insurance coverage Fees 30 years old $18 $15 40 years old $28 $23 50 years old $67 $51 Source: Quotacy. Quotes are for a $250,000 30-year term life policy, for guys and ladies in superb wellness.

Term Life Insurance For Police Officers

Passion rates, the financials of the insurance firm, and state regulations can likewise affect premiums. When you take into consideration the amount of coverage you can obtain for your premium dollars, term life insurance often tends to be the least expensive life insurance coverage.

Thirty-year-old George wishes to secure his household in the not likely event of his passing. He buys a 10-year, $500,000 term life insurance policy plan with a costs of $50 each month. If George dies within the 10-year term, the policy will pay George's recipient $500,000. If he dies after the plan has actually ended, his beneficiary will obtain no advantage.

If George is identified with a terminal disease throughout the first policy term, he most likely will not be qualified to restore the plan when it runs out. Some plans offer ensured re-insurability (without evidence of insurability), yet such functions come at a higher cost. There are several types of term life insurance.

The majority of term life insurance policy has a level premium, and it's the type we have actually been referring to in many of this article.

Ad&d Insurance Vs Term Life Insurance

Term life insurance is attractive to young individuals with youngsters. Parents can get substantial protection for an affordable, and if the insured passes away while the policy holds, the family can rely upon the fatality advantage to replace lost earnings. These plans are likewise appropriate for individuals with growing families.

The appropriate choice for you will rely on your demands. Here are some things to consider. Term life plans are suitable for people that desire significant protection at a reduced cost. Individuals that have entire life insurance policy pay more in costs for much less coverage but have the safety of recognizing they are protected for life.

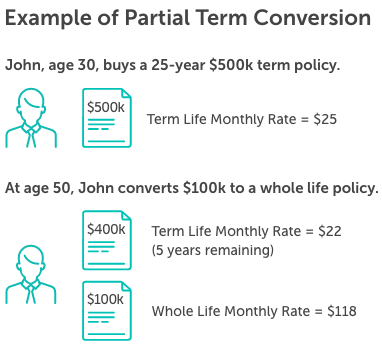

The conversion biker ought to enable you to transform to any kind of long-term plan the insurance provider supplies without constraints - compare decreasing term life insurance. The main attributes of the motorcyclist are maintaining the original health ranking of the term policy upon conversion (even if you later have wellness problems or end up being uninsurable) and deciding when and how much of the insurance coverage to convert

Of course, total premiums will boost significantly given that entire life insurance policy is much more pricey than term life insurance policy. Clinical problems that establish throughout the term life duration can not create premiums to be raised.

Entire life insurance coverage comes with considerably greater month-to-month costs. It is meant to offer coverage for as lengthy as you live.

Term To 100 Life Insurance

It depends upon their age. Insurance provider established an optimum age limit for term life insurance policy plans. This is normally 80 to 90 years old yet might be greater or lower relying on the business. The premium additionally increases with age, so a person aged 60 or 70 will certainly pay significantly more than somebody decades more youthful.

Term life is somewhat similar to automobile insurance coverage. It's statistically unlikely that you'll need it, and the premiums are cash down the tubes if you don't. If the worst takes place, your family members will get the benefits.

This policy style is for the consumer that needs life insurance policy however want to have the capability to select just how their money value is invested. Variable plans are financed by National Life and dispersed by Equity Services, Inc., Registered Broker/Dealer Associate of National Life Insurance Policy Firm, One National Life Drive, Montpelier, Vermont 05604.

For J.D. Power 2024 award details, visit Irreversible life insurance policy develops cash worth that can be borrowed. Plan financings build up interest and overdue plan fundings and passion will lower the survivor benefit and cash money worth of the plan. The amount of cash money value available will normally rely on the kind of irreversible plan bought, the amount of protection bought, the length of time the plan has been in force and any type of outstanding plan loans.

Term Life Insurance Blog

Disclosures This is a general description of protection. A total declaration of protection is discovered just in the policy. For even more information on coverage, expenses, constraints, and renewability, or to use for coverage, contact your regional State Farm representative. Insurance coverage and/or connected riders and functions might not be readily available in all states, and plan terms and problems might vary by state.

The major differences between the different kinds of term life policies on the marketplace involve the size of the term and the insurance coverage amount they offer.Level term life insurance policy comes with both level premiums and a level fatality advantage, which means they stay the exact same throughout the period of the policy.

, likewise understood as an incremental term life insurance plan, is a policy that comes with a death benefit that increases over time. Typical life insurance coverage term sizes Term life insurance is inexpensive.

The major differences between term life and entire life are: The length of your insurance coverage: Term life lasts for a set duration of time and after that runs out. Average monthly whole life insurance policy price is calculated for non-smokers in a Preferred wellness category, acquiring an entire life insurance coverage plan paid up at age 100 used by Policygenius from MassMutual. Aflac offers many long-lasting life insurance coverage plans, including whole life insurance, last cost insurance, and term life insurance.

Table of Contents

Latest Posts

10 Year Renewable Term Life Insurance

Aig Burial Insurance

Final Burial

More

Latest Posts

10 Year Renewable Term Life Insurance

Aig Burial Insurance

Final Burial